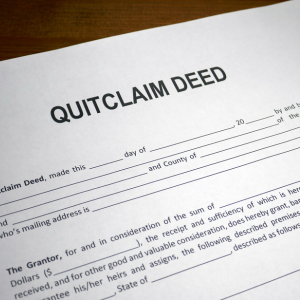

Key Steps to File a New York Quitclaim Deed

It’s easy to give someone else property rights in New York by filing a quitclaim deed. Take a look at this easy guide:

- Obtain a Quitclaim Deed Form

Get a quitclaim deed form designed for New York real estate transfers and ensure it meets NY property transfer rules. - Complete the Form Accurately

Names of the grantor and grantee and a description of the land must be filled out. Check that everything is right. - Notarize the Deed

Have the quitclaim deed notarized per New York’s requirements. This step makes your document legally valid. - File the Deed with the County Clerk

Submit the completed and notarized deed to the county clerk where the property is located. Check with the county for specific filing steps. - Pay Applicable Fees

Be ready to pay any recording fees required when filing the quitclaim deed. These fees vary by county.

Preparing Your Quitclaim Deed Form

Preparing your quitclaim deed form involves several important steps:

- Research Requirements: Learn about New York quitclaim deed requirements to ensure you follow the rules.

- Complete Details: Fill in all necessary information correctly to prevent issues during filing.

- Use of Resources: Consider using online tools, like free form services, to help with preparation.

Understanding Notarization Requirements for NY Quitclaim Deeds

Notarization is vital for a quitclaim deed in New York. Here’s what you need to know:

- Role of a Notary Public: A notary public must witness the signing of the deed to verify its authenticity.

- Legal Importance: The deed may not be legally valid in New York without notarization.

- Obtaining Notarization: Find a licensed notary in New York to notarize your quitclaim deed.

What Documents Are Needed to File a Quitclaim Deed in NY?

Before you file a quitclaim deed, gather these documents:

- Completed Quitclaim Deed: The main document for the deed transfer.

- Proof of Identity: Valid ID for both the grantor and grantee.

- Property Description: Legal description of the property in question.

- Additional Forms: Any other forms the county requires for filing.

Where Should I File My Quitclaim Deed in New York?

To properly file your quitclaim deed, follow these steps:

- County Clerk’s Office: File the deed at the county clerk’s office where the property is located. This is required for real estate transactions.

- Verify Procedures: Each county might have different procedures and fees, so contact the county clerk or check their website for current details.

The Recording Process for Quitclaim Deeds in NY

A quitclaim deed is a necessary paperwork used in New York to convey real estate interests without guarantee. Usually, family members or close friends use this deed. To negotiate the deed-recorded process:

- Preparation: Begin by drafting the quitclaim deed. It should include the names of the grantor and grantee, a legal description of the property, and the transfer date.

- Execution: Have the grantor sign the deed. Notarizing the signature is recommended for authenticity.

- Submission: Submit the executed deed to the county clerk’s office where the property is located. This is where the deed will be recorded.

Recording the quitclaim deed updates the public record, notifies others of the transfer, and updates the property’s title chain.

How Long Does It Take to Record a Quitclaim Deed in NY?

The time to record a quitclaim deed in New York varies by several factors, including the county’s workload and filing efficiency. Generally, the process takes two to six weeks. Consider these factors:

- County Office Workload: Busier counties may experience longer processing times.

- Filing Process Efficiency: Differences in county clerk procedures can affect processing speed.

- Document Accuracy: Complete, accurate documentation helps avoid delays from corrections or resubmissions.

Once recorded, the quitclaim deed becomes part of the public record, confirming ownership transfer.

Fees Associated with Recording a Quitclaim Deed

Recording a quitclaim deed in New York comes with several costs:

- Filing Fee: Typically $25 to $50, varying by county.

- Recording Costs: Additional charges might apply based on page count or extra documents.

- Miscellaneous Expenses: Notarization fees or other administrative costs may arise.

Contact the county clerk’s office for precise estimates of these expenses.

Why Accurate Recording is Important for NY Property Transfers

Accurate recording of a quitclaim deed in New York is important for several reasons:

- Establishes Legal Ownership: Properly recorded deeds confirm the new owner’s rights.

- Prevents Future Disputes: Public recording reduces the risk of future disputes or claims.

- Ensures Clear Title: Accurate recording maintains a clear and marketable title, which is crucial for future transactions.

Attention to detail in the recording is key to a seamless property transfer in New York, especially in high-value real estate markets like New York City. Consider consulting experts like I Buy Homes Rochester to help with quitclaim deeds or real estate transactions.

Legal Implications of Filing a Quitclaim Deed

Especially in real estate transactions involving New York property ownership, it is crucial to know the legal ramifications of a quitclaim deed you file. Quitclaim documents are common for fast property rights transfer and contain restrictions, but they are rather popular. Unlike warranty documents, quitclaim deeds do not guarantee the grantor has a legitimate title, which can cause possible conflicts over property ownership.

What Legal Advice Should Be Sought for NY Quitclaim Deeds?

Before using a quitclaim deed for property transfer in New York, seeking legal advice from a knowledgeable real estate attorney is crucial. A lawyer familiar with New York’s quitclaim deed requirements will guide you on whether this deed suits your needs. They ensure that the process follows state laws correctly, minimizing potential legal problems. They can also help verify the validity of the title and draft the deed properly.

Are There Tax Implications When Using a Quitclaim Deed in NY?

Using a quitclaim deed in New York can affect your taxes. Property transfers might influence property taxes and could lead to state tax obligations. It’s wise to consult with a tax professional or real estate attorney to grasp these tax implications fully. They can offer specific advice on how the quitclaim deed may impact your taxes, ensuring compliance with New York state tax rules.

Common Mistakes to Avoid When Filing a Quitclaim Deed

Filing a quitclaim deed in New York requires attention to detail. Common errors include:

- Incorrect Information: Check to ensure all deed details, such as names and property descriptions, are correct.

- Failure to Obtain Proper Signatures: The grantor must sign the deed before a notary public.

- Not Meeting State Requirements: Understand the specific New York state requirements for quitclaim deeds.

- Overlooking the Title Search: Conduct a thorough title search to confirm that there are no outstanding claims or liens on the property.

Avoiding these mistakes streamlines the quitclaim deed process and prevents legal and financial issues.

For further help, contact I Buy Homes Rochester to explore your quitclaim deed options and ensure all transactions are handled smoothly and legally.

Exploring Alternatives to Quitclaim Deeds

When transferring property in New York, it’s smart to look at different deed types to suit your situation. Quitclaim deeds are simple and often used when legal protection isn’t a big concern. But they don’t provide a warranty for the title, which might be necessary in some cases.

If you want more security, consider a warranty deed. This deed guarantees the seller owns the property and can sell it, offering stronger protection against future ownership claims or disputes.

Talking to a real estate attorney for legal advice can help you choose the right deed. Knowing the impact of each option helps you make informed decisions about property ownership.

Comparing Quitclaim Deeds to Warranty Deeds

Understanding the difference between quitclaim deeds and warranty deeds is important in New York real estate deals. Quitclaim deeds transfer ownership without a guarantee of the property’s title status. On the other hand, warranty deeds ensure the grantor has a good title and will cover the grantee against future ownership claims. This is crucial when large financial sums or legal issues are involved.

For formal sales, especially between strangers, warranty deeds are safer due to their legal protection. Quitclaim deeds work for informal transactions between family members or to resolve title issues. Knowing these differences lets you pick the deed that best fits your needs and rights.

When Is a Quitclaim Deed Not Appropriate for NY Real Estate?

Simple transfers benefit from quitclaim deeds; nevertheless, they are not always appropriate for every New York real estate scenario. They are less suited when complete protection is required as they do not justify the property title. Should you require clear ownership documentation or deal with third-party purchasers, you could choose safer options such as warranty deeds.

Legal counsel is wise in guiding these decisions. Consulting experts help you obey New York’s real estate rules and prevent conflicts or losses during property transfers.

Other Property Transfer Methods in New York

Besides quitclaims and warranty deeds, New York offers several other ways to transfer property:

- Bargain and Sale Deed: Common in tax or foreclosure sales, it offers limited title warranties.

- Executor’s Deed: Used by executors to transfer property owned by someone deceased.

- Referee’s Deed: After a court proceeding, such as a foreclosure, to confirm a property’s sale.

Choosing the right method is key to a smooth real estate transaction. According to New York deed transfer laws, each type has its rules and costs, affecting expenses like the cost of the deed transfer. Speaking with a real estate expert clarifies the best approach and helps meet legal standards.

Navigating the NY Real Estate Transfer Laws

Changing property ownership in New York requires knowing several deed forms, including quitclaim deeds. Real estate deals feature these instruments since they are quick and easy. However, you must be well-versed in properly observing NY property transfer rules and safeguarding everyone involved.

How Do NY Laws Affect Quitclaim Deeds?

Quitclaim deeds in New York allow the transfer of interest in a property without guaranteeing the title. This makes them different from other types of deeds that provide warranties to the buyer. Understanding how these deeds work under New York’s real estate laws is important, especially in terms of tax implications. A quitclaim deed may simplify the transfer process, but it can affect property taxes differently than other deeds. Seeking legal advice is wise to handle these details properly.

What Are the Eligibility Criteria for Filing a Quitclaim Deed in NY?

Anyone interested in a property in New York can register a quitclaim deed, but only under specific guidelines. The deed must name the grantor and grantee to be notarized precisely to be legitimate. By fulfilling these legal obligations, one helps avoid possible conflicts.

Understanding the Role of County Clerk in NY Quitclaim Deeds

The county clerk is very important when a quitclaim property is signed off. After the deed is written up and signed, it must be filed with the right county clerk’s office to be valid. Registering a deed in New York is the first step in writing it. The clerk will then store the document in public records. This step makes the move official and lets everyone know about the change in ownership. To follow New York law, you must know where to file a quitclaim deed.

This information applies to New York and its cities like Rochester, Greece, Hilton, and more. For help or questions, call us at (585) 940-2447. You can also visit our website at I Buy Homes Rochester for more details.

FAQs:

What is a Quitclaim Deed and How Does it Work in NYC?

A Quitclaim Deed transfers property ownership without any warranty. In NYC, it’s often used for ownership changes among family members. The deed must be recorded correctly in public records to ensure legal recognition.

How Do I Apply for a New Deed in New York State?

To apply for a new deed in NYS, fill out a Quitclaim Deed form, have it signed before a notary, and submit it to the County Clerk’s office for recording. Make sure all details are correct to prevent future issues.

Is There a Specific Form for Filing a Quitclaim Deed in NYC?

Yes, NYC requires a specific Quitclaim Deed form. Complete the form accurately, have it notarized, and record it with the City Register to finalize the property transfer.

Can You Explain How to Record a New Property Document in New York?

Recording a new document involves submitting the completed deed to the county office. This updates public records and legally acknowledges the change in property ownership.

What Are Common Concerns When Updating a Property Deed in NY?

Accuracy is key when updating a deed. Be aware of impacts on mortgage agreements and consider legal advice to handle covenants and warranties properly.

How Can Personal Situations Like Injury or Mortgage Affect a Quitclaim Deed?

In cases of personal injury or existing mortgages, seeking legal guidance is important. These factors can affect or complicate the transfer due to covenants or financial obligations.

What Legal Terminology Should I Understand in Quitclaim Deeds?

Learn terms like “warranty,” “covenants,” and “recording” to understand the legal responsibilities when executing a Quitclaim Deed.

Are There Common Mistakes to Avoid When Filing Quitclaim Deeds in NY?

Avoid incomplete forms, incorrect fees, and misunderstandings about mortgage effects. Always double-check details and consider getting legal help if necessary.

Key Insights

- Understanding the legal details can save time and money when applying for a new deed form in NYC or NYS.

- A credit score check might be necessary when filing a deed. Ensuring its accuracy is important for financial transactions.

- If you’re starting a business, especially startups, clear privacy policies and strong communication channels build trust and transparency.

- Combining real estate needs with legal advice on personal injury or car accidents can be efficient. Consult a personal injury attorney to address both.

- Enhance your website’s security and functionality with tools like RSS feeds and Cloudflare, especially if you’re in real estate or law.

- Buyers from Australia or Canada interested in international properties should understand local laws and cultural aspects, including religion and community factors.

- Use formfree processes to simplify loan or cash transactions, avoiding unnecessary paperwork.

- Real estate evaluations should consider potential damages to provide accurate assessments, especially in premium markets like Florida.

- Conduct background checks and review employee records for effective property management, ensuring reliability and safety.

- Consider subscription models in legal services for continuous updates and support, which benefits contexts involving lawyers or legal shield services.

Additional Resources For New York Sellers